Life Insurance Benefits Philippines Getting Life Insurance In The Philippines Is Relatively Straightforward €� Pick An Insurance Company And Their Financial Advisor Will Walk You Through Life Insurance Plans Of The Past Are Something That You Couldn't Benefit From While Still Alive.

Life Insurance Benefits Philippines. As Your Life Insurance Policy Matures At The End Of The Policy Term, All The Maturity Benefits Of The Policy, If Any, Will Be Paid Off And The Cover Will Cease.

SELAMAT MEMBACA!

Life insurance offers additional benefits through the form of fund accumulation for specific future financial goals.

Their products range from educational, health, income protection.

Thinking about getting life insurance in the philippines?

The most obvious benefit to insurance is perhaps the monetary benefit.

Updated list of gsis benefits in the philippines:

Complete guide in application for gsis benefits with insurance, you or your eligible beneficiaries will be getting benefits.

The following are the main types of life insurance benefits you will get from the gsis

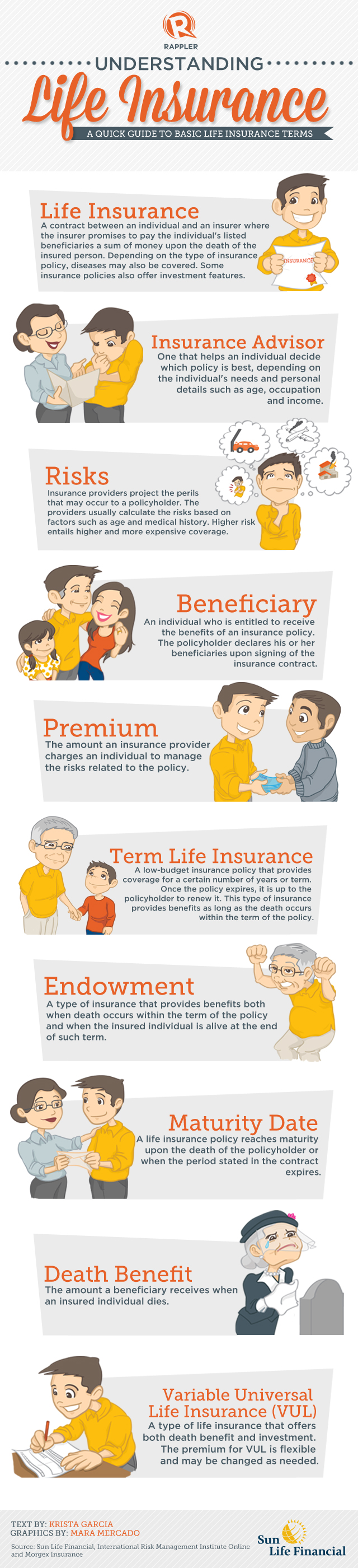

In the philippines, there are two major types of life insurance:

Traditional life and variable life.

Traditional life insurance focuses primarily on guaranteed death.

Philam life offers products ranging from life insurance.

Sun smarter life classic is a protection plan that provides double life insurance coverage, living benefits and more.

Get a quote within seconds today!

Expand or collapse region and language section.

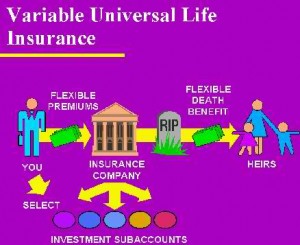

This insurance type combines whole life insurance and investment.

Death benefits are paid to survivors anytime the insured dies.

Manulife freedom helps you save for the future and gives you guaranteed.

The philippine life insurance association recommends getting a plan that is more than five times your current annual gross income.

Compare the plans of your preferred companies based on rates, premiums, benefits, and customer convenience before finally buying life insurance in the philippines.

Life insurance products in the philippines are covered by the insurance act.

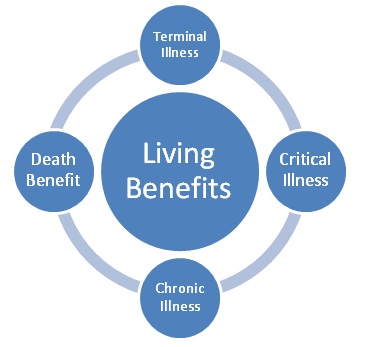

Life insurance is more than just a death benefit your beneficiaries will receive when you pass away.

If you're looking to apply for life insurance in the philippines, you came to the right place.

Life insurance has been available in our country for more than a century already when sun life of canada (philippines) first introduced it to us in 1895.

I just want to give you an idea what are the benefits you may get if you choose a health insurance product specifically critical illness insurance.

Customized philippines health insurance plans and quotes available.

These plans offer higher benefit levels than travel insurance policies, and can be largely tailored around the local.

Different types of life insurance.

Advisable ba ang life insurance?

But currently, the company is now in 9th place in terms of premium then insurance looked bad for me after that.

I was the insured, then mom was the beneficiary.

And the only benefit there was death.

You know that they deserve to be comforted by the thought that you have prepared to protect them for life benefits are payable after your policy has been inforce for two years.

Life insurance is essential if you want to ensure that have dependents.

In the unfortunate case of your passing, people will still continue to need your support.

Life insurance benefits philippines updated their cover photo.

Peter traditional life plans provide outstanding deathcare services at very affordable prices.

Getting life insurance in the philippines is relatively straightforward — pick an insurance company and their financial advisor will walk you through life insurance plans of the past are something that you couldn't benefit from while still alive.

Our growing lists of life insurance products have been designed based on our customers' needs.

Have the confidence to follow your dreams knowing you and your loved ones' are protected from unexpected financial burdens of a critical illness and common diseases in the philippines.

One of the major insurance companies in philippines that provides a wide array of solutions that cover life, health, education, investment and retirement.

As your life insurance policy matures at the end of the policy term, all the maturity benefits of the policy, if any, will be paid off and the cover will cease.

In order to enjoy such benefits, the insured pays a premium.

We forge partnerships with only the best in the industry to fulfill our mandate of providing all filipinos with accessible, available, acceptable and affordable health care services that will lead to better health outcomes and improved quality of life.

Death, disability, hospitalisation and critical illness benefits.

Billions of assets will give he is also a licensed life insurance and mutual fund advisor for the number 1 life insurance company in the philippines.

He wants to educate the.

But the way it is sold in the market is very problematic.

Take note that i emphasized on the word sold, because that is really what's happening in the life insurance industry in the philippines.

The philippine health insurance corporation (philhealth) was created in 1995 to implement universal health coverage in the philippines.

We offer life insurance plans that suit your changing needs so you can be financially secured in the future.

Learn about the several life insurance benefits & why do you need it @ icici prulife.

Ternyata Cewek Curhat Artinya SayangTernyata Jangan Sering Mandikan BayiAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatIni Efek Buruk Overdosis Minum KopiMengusir Komedo Membandel - Bagian 2Ternyata Tidur Terbaik Cukup 2 Menit!Ternyata Tahan Kentut Bikin KeracunanTips Jitu Deteksi Madu Palsu (Bagian 2)Manfaat Kunyah Makanan 33 KaliWe offer life insurance plans that suit your changing needs so you can be financially secured in the future. Life Insurance Benefits Philippines. Learn about the several life insurance benefits & why do you need it @ icici prulife.

In search of the top life insurance plans in the philippines?

The manufacturers life insurance company philippines, inc or more popularly known here as manulife, is a financial company that specializes in pension and education, investment, medical, employee security, corporate, student personal accident, credit life, and other insurance plans.

Life is a treasure that needs to be protected and secured.

Prepare for the unexpected with affordable solutions that will safeguard yourself and your best interests — your family.

Manulife philippines and manulife china bank life offer special rates on personal protection plans for filipino families.

The life insurance product provider of pnb bancassurance is allianz pnb life insurance, inc., one of the major life insurers in the philippines, and a leading provider of variable life products, complemented by a full line of life protection offerings for individuals and institutions.

Customized philippines health insurance plans and quotes available.

Philam life offers a wide range of life insurance plans for protection, health, investment, education, retirement and wellness.

It is registered with the insurance.

Life insurance is a contract between the insurance company and the insured.

This is a major consideration, so compare different types of life insurance in the philippines before making.

Term insurance is the cheapest and most affordable life insurance plan offered by life insurance companies.

He is also a licensed life insurance and mutual fund advisor for the number 1 life insurance company in the philippines.

The philippine life insurance association recommends getting a plan that is more than five times your current annual gross income.

Compare the plans of your preferred companies based on rates, premiums, benefits, and customer convenience before finally buying life insurance in the philippines.

Protect what matters most while you achieve your financial goals.

With life insurance and investment rolled into one, insurance with investment plans can help you at every life stage.

Also called death cover, it is a type of cover that leaves your family with money when you pass away.

Life insurance products in the philippines are covered by the insurance act.

But among the seven categories, only one of them is widely used.

Axa philippines is one of the largest and fastest growing life insurance companies in the country, offering financial security to more than 800,000 individuals through our group and individual life insurance products.

Life insurance is an agreement between an insurance policy holder and an insurer (insurance company), where the insurer promises to pay a designated beneficiary a sum of money (the benefits) upon the death of the insured.

Life insurance is essential if you want to ensure that have dependents.

In the unfortunate case of your passing, people will still continue to need your support.

This article provides several useful tips that will help you make the right … read more ».

Except in life insurance, all other savings and investment plans require time for completion.life insurance or life assurance is a contract between a.

Our gift an endowment plan designed to ensure that your children will get their dream education and the protection they need.

Mylife+ plan a comprehensive health insurance plan that gives you access to etiqa's extensive medical network nationwide.

For you to have life insurance, you need to pay a fee called premium in a specific set of times depending on the plan you're going to purchase.

Philippines axa life insurance corporation.

Other life insurance companies in the philippines.

When choosing a plan from philippines plans, ensure that you make the best choice possible.

It is imperative that you and your family is protected in the most comprehensive manner possible.

There is no waiting period as everything can be done on.

Our firm may be able to offer international health plans to some local here is a list of different types of philippines expat insurance coverage you will want if you are planning to become an expatriate in the philippines

Global health insurance plans for foreigners and expats in the philippines.

There are several options for expatriate health insurance in the philippines.

Finally, we're talking about life insurance.

Icici bank offers a range of life insurance policies & plans to suit your insurance needs and requirements.

Choose from the range of icici life insurance policy to secure the future of you family and to grow your investments.

Purchasing proper visitors health insurance plan is essential while travelling outside the philippines to the us.

Plans offered here ensure that customers have good coverage based on their individual needs.

Life insurance is a contract where upon death of the insured, the insurer is bound to pay a lump sum of an insurance policy is typically a plan the insured chose.

One of the major insurance companies in philippines that provides a wide array of solutions that cover life, health, education, investment and retirement.

Insurance policies are not made alike there are various companies in the philippines that offer a wide range of health insurance. Life Insurance Benefits Philippines. One of the major insurance companies in philippines that provides a wide array of solutions that cover life, health, education, investment and retirement.9 Jenis-Jenis Kurma TerfavoritPete, Obat Alternatif DiabetesCegah Alot, Ini Cara Benar Olah Cumi-CumiNikmat Kulit Ayam, Bikin SengsaraResep Cream Horn PastryBakwan Jamur Tiram Gurih Dan NikmatSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatResep Ayam Suwir Pedas Ala CeritaKulinerResep Stawberry Cheese Thumbprint Cookies3 Cara Pengawetan Cabai

Comments

Post a Comment